Byron Bay continues to captivate Australians seeking a lifestyle change, offering pristine beaches, a vibrant community, and a laid-back atmosphere. However, the popularity of Byron Bay has led to a surge in property demand, making the market highly competitive.

This demand has extended to neighbouring towns, creating the “Byron Bay halo” effect. These surrounding areas offer similar lifestyle benefits, often at more accessible price points, attracting both sea-changers and tree-changers.

But there’s one thing movers quickly discover: Property in the Byron region moves fast!

Stock is limited, demand is high, and managing the logistics of buying in one location while selling in another can be overwhelming.

Here’s how to find your ideal home — and how Funding can help you bridge the gap with confidence.

Where to look: The Byron Bay halo effect

As Byron Bay has matured into a global icon, surrounding towns and villages have emerged as lifestyle destinations in their own right — offering access to the region’s charm, without Byron’s premium price tag.

Here are some standout locations benefiting from the Byron halo:

1. Bangalow

-

Why it’s great: Historic charm, vibrant village atmosphere, close to Byron.

-

Median house price*: $1,600,000

-

Ideal for: Tree-changers seeking lush surrounds and community spirit.

2. Lennox Head

-

Why it’s great: Beautiful beaches, lively cafés, and airport convenience.

-

Median house price*: $1,600,000

- Median apartment price*: $1,150,000

-

Ideal for: Sea-changers wanting the surf lifestyle with modern amenities.

- Distance to Byron Bay: 19.2km (22 mins)

3. Newrybar

-

Why it’s great: Boutique hinterland living with a foodie edge.

-

Median house price: Approx. $2.3m

-

Ideal for: Buyers chasing privacy, acreage and sophistication.

- Distance to Byron Bay: 16km (21 mins)

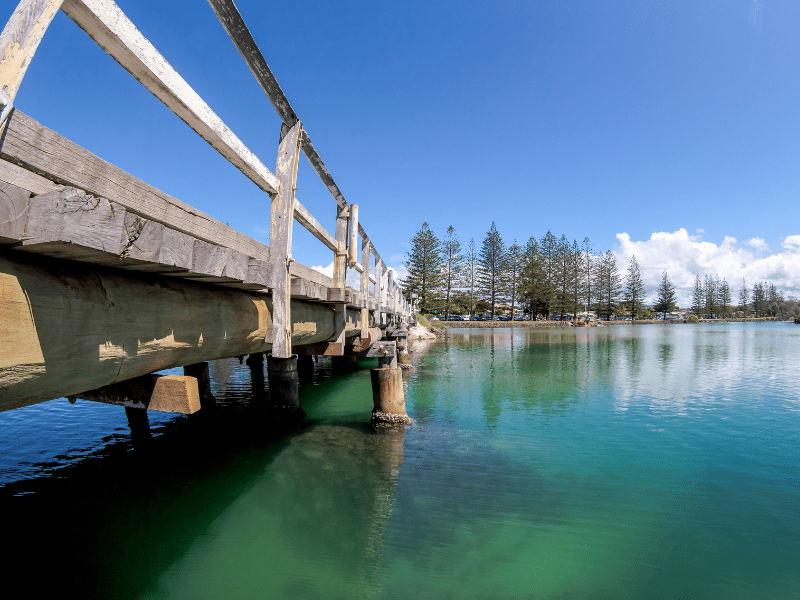

4. Brunswick Heads

-

Why it’s great: Relaxed coastal village life, river access, and surf culture.

-

Median house price*: $2,025,000

- Median apartment price*: $1,080,000

-

Ideal for: Those craving coastal charm without the crowds.

- Distance to Byron Bay: 17km (approximately 17 mins)

5. Mullumbimby

-

Why it’s great: Creative energy, strong community, lush hinterland setting.

-

Median house price*: $1,046,000

-

Ideal for: Tree-changers wanting authenticity, lifestyle, and value.

- Distance to Byron Bay: 18.3 km (approximately 21 mins)

5. Ocean Shores

-

Why it’s great: Lush hinterlands, pristine beaches and a relaxed, community-focused lifestyle.

-

Median house price*: $1,150,000

- Median apartment price*: $892,500

-

Ideal for: Sea-changers seeking quick access to leisure activities, convenience and amenities

- Distance to Byron Bay: 20.6 km (approximately 20 mins)

* RealEstate.com.au (April 2024 – March 2025)

The real challenge: buying and selling across different markets

Whether you’re selling in a major city or a suburban market, the challenge remains:

-

Finding and securing your dream home before it’s snapped up

-

Selling your existing home at the right time and right price

Coordinating both transactions perfectly is difficult — and delays or missed opportunities can be costly.

How a bridging loan can help you move with confidence

This is where a bridging loan from Funding makes all the difference.

With a bridging loan, you can:

-

Secure your home first, without rushing your sale

-

Negotiate from a position of strength, not panic

-

Move on your timeline, not the market’s

-

Minimise the stress of juggling two transactions across different locations

Funding specialises in fast, flexible bridging finance tailored for lifestyle movers — whether you’re chasing the coast, the hinterland, or a bit of both.

Why Funding?

When you’re ready to make a major life move, you need a finance partner who moves with you — not behind you.

Funding offers:

-

Streamlined approvals to help you act fast

-

Specialist bridging loan structures designed for property transitions

-

Responsive, human service when you need it most

We’ve helped thousands of Australians bridge the gap to their new lifestyle — and we’re ready to help you too.

Take the next step towards your Byron dream

Don’t let the fast-paced market deter you from securing your ideal home in the Byron Bay region. With the right financial strategy, you can make your lifestyle change a reality.