I had the pleasure of dealing with John Bryant as our credit manager for our home loan, and I couldn’t be happier with the experience. John was not only extremely professional but also incredibly helpful throughout the entire process. He took the time to understand our needs and patiently guided us through every step. His expertise and dedication made the process smooth and stress-free.

Build your way, backed by Funding

Construction financing crafted to help entrepreneurial builders and investors bring plans to life, on time and on budget.

Quick approvals and upfront drawdowns mean no project delays.

Borrow $25K - $10M

Settle in 3 days*

1 to 36 month terms

LVR up to 70%

Your project, your vision—backed by the right finance.

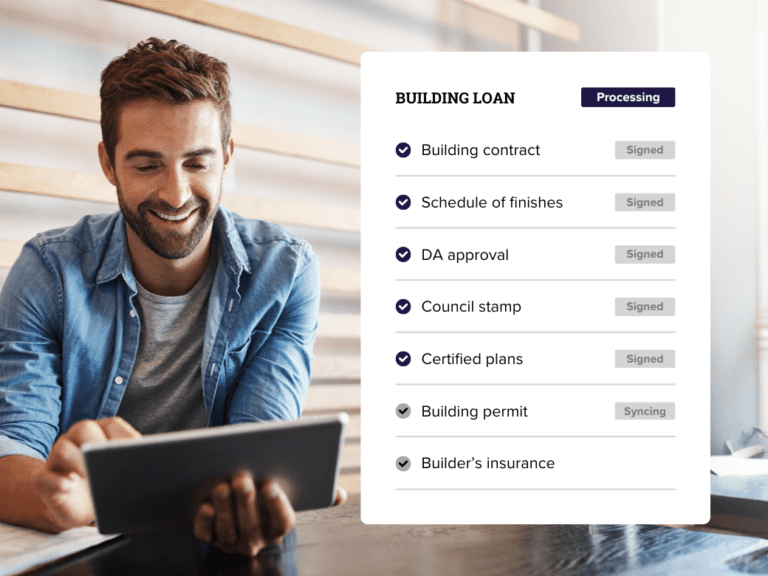

Powered by technology, backed by expertise.

Get up-front access to funds

Immediate access to funds can be crucial for keeping your development on schedule and under budget. That’s why we offer up-front drawdowns, allowing you to access the capital you need right when it matters most. Streamline your cash flow from the start and keep your projects moving smoothly without the wait.

The go-to for fast finance.

We’re not just fast; we’re forward-thinking. Our building loan uses innovative technology to fast-track the process, helping us to deliver industry-leading turnaround times with settlements possible within 3 days from formal approval.

Success secured with Funding

Apply online now:

Our easy-to-use and secure online form takes minutes to complete

Get approved today:

Conditional approval provided within 4 hours*

Personalised service:

Expert team to help you move forward faster

Settlement within 3 days*:

Fast settlement after formal approval

Get started with a Funding building loan

Our building loan can accelerate your construction project, making the transition from blueprint to build both fast and simple. Don’t let cash flow stall your dreams—bridge the gap with Funding and keep your project on track.

Move your project forward faster

Fast

funds

Simple

process

Personal

service

Easy

settlement

Downsizing?

It's your time.

Your questions answered

The obligation free conditional approval will outline all rates and fees. It is tailored to your specific loan needs.

The loan to value or LVR is the maximum lend secured over the property. Our typical LVR is 65% or lower of the property value. On some occasions, 70% may be considered depending on the location and type of security property.

Loan terms are typically between 1-24 months.

Residential, commercial and vacant land across Australia.

Borrowers can be individuals, companies or trusts borrowing for any purpose including personal or business. Borrowers must have sound real estate security, the ability to meet their repayments and a strong repayment strategy to exit the loan at the end of the term.

A construction home loan is a type of mortgage specifically designed for individuals planning to build a new home or undertake significant renovations on an existing property.

Confidence grows with knowledge

Move Forward Faster