Unlocking your Growth Potential with Funding

Empowering small developers for medium-density housing growth. Learn how Funding.com.au makes it possible.

Empowering small developers for medium-density housing growth. Learn how Funding.com.au makes it possible.

Empowering small developers for medium-density housing growth. Learn how Funding.com.au makes it possible.

Global supply chain disruptions and subsequent rapid price increases continue to plague the construction industry, never has it been more important to think outside the box to seek fast building or construction finance.

With the increased need for bridging loans, Funding.com.au products have become the number one solution for brokers and their customers.

If you’ve started building or found your dream home, and need approval fast, or when banks can’t lend you money as quickly as you need it, it can be a very stressful time.

If you’re a broker, we recommend polishing up on the ins and outs of Private Funding so you can offer your clients secured, short-term finance solutions when the banks have otherwise said no.

In part two of our broker educational series, we sit down with Funding’s Senior Credit Manager, Arrin Bowker, to discuss why a clear and genuine loan purpose is so important to the success of a private lending application.

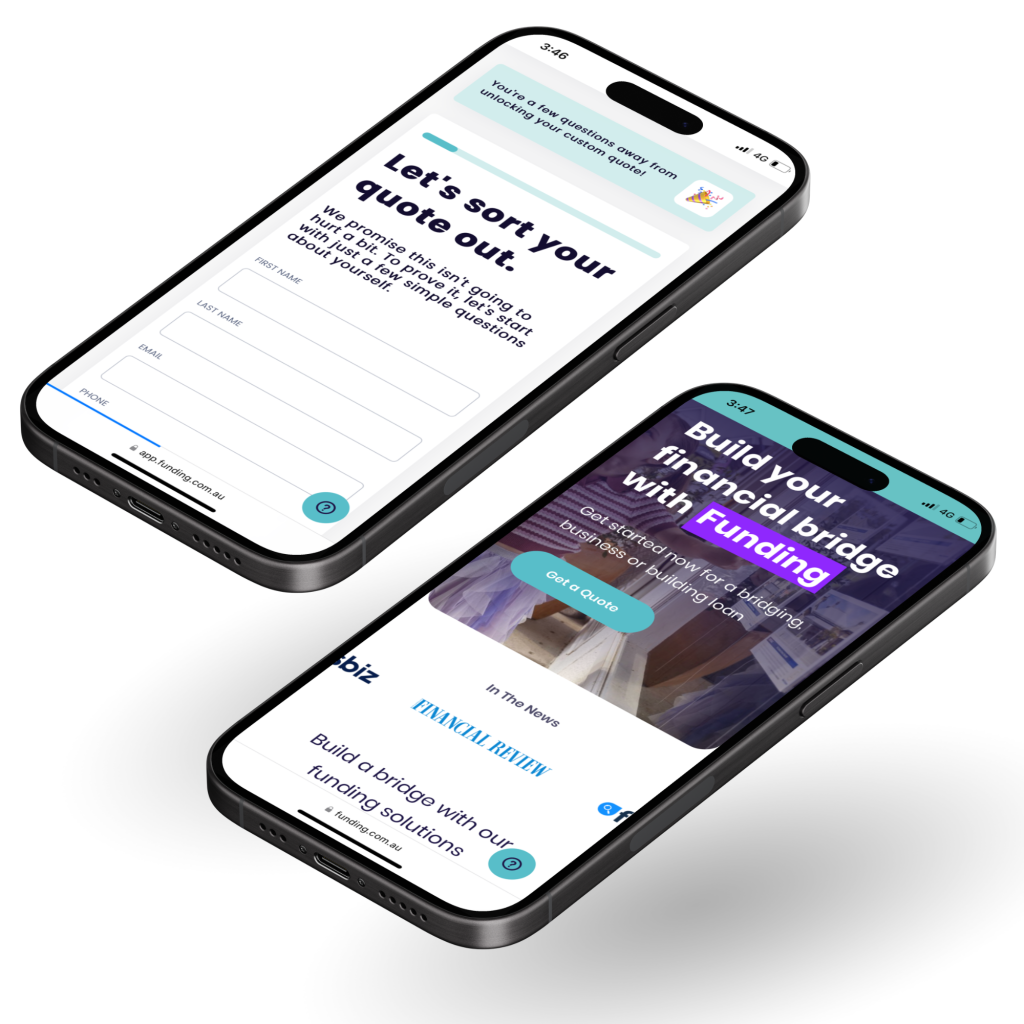

Our innovative technology simplifies short-term finance and investments, helping Australians to get ahead sooner.

Ending 30th June 2022, please find information overview of first mortgage investments made available during the quarter for the Funding Investment Trust (FIT).

Ending 30th June 2022, please find information overview of first mortgage investments made available during the quarter for the Funding Investment Trust (FIT).

Ending 31st March 2022, please find information overview of first mortgage investments made available during the quarter for the Funding Investment Trust (FIT).

With many new opportunities lies many new questions, so we’ve compiled our most frequently asked questions below to give you the head start on what you need to know before you start investing.

Ending 31 December 2021 Please find below information overview of first mortgage investments made available during the quarter for the Funding Investment Trust (FIT). All completed loans since inception have…

Ending 30 September 2021 Please find below information overview of first mortgage investments made available during the quarter for the Funding Investment Trust (FIT). All completed loans since inception have…

Global supply chain disruptions and subsequent rapid price increases continue to plague the construction industry, never has it been more important to think outside the box to seek fast building or construction finance.

With the increased need for bridging loans, Funding.com.au products have become the number one solution for brokers and their customers.

Recently, Funding had the opportunity to work with a retired couple, looking to knockdown their existing home and build two brand-new townhouses. They were having trouble with other lenders and…

With home builders abandoning jobs and properties taking longer to sell, brokers are creating happy customers with an innovative bridging finance solution that takes the pressure off their clients Funding,…

With the rise in costs of materials, and a skills shortage driving the wages up, builders with fixed-priced contracts is causing delayed work and a rise in incomplete construction. Funding’s…

What are second mortgages? A second mortgage is a second charge over a property that already has another mortgage on it. The mortgages are ranked in the order in which…